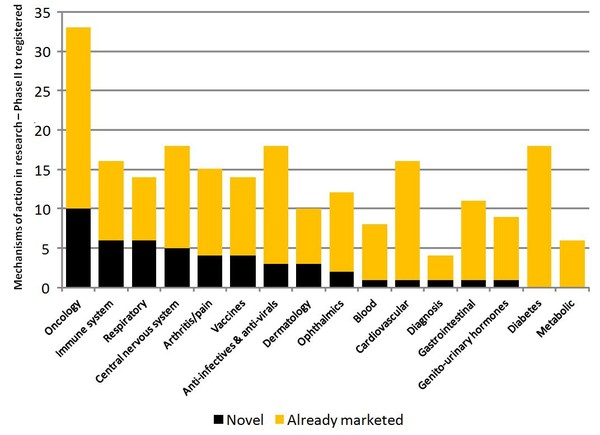

There are more than 200 new biotechnology products in the pipeline (phase II to registered), all of which could be future targets for biosimilars. However, around 60% of these products concern mechanisms of action that are already available, see Figure 1 [1].

- Home

-

Generics

News

- FDA approves generic teriparatide and levetiracetam

- US generics launch and approval for Dr Reddy’s and Lupin

- Five Chinese companies join UN’s MPP for Covid-19 medicines

- South Korean companies to make generic Bridion and COVID-19 drugs

Research

- Japan’s drug shortage crisis: challenges and policy solutions

- Saudi FDA drug approvals and GMP inspections: trend analysis

- Generic medications in the Lebanese community: understanding and public perception

- Community pharmacists’ understanding of generic and biosimilar drugs: Lebanon case study

-

Biosimilars

News

- FDA approves Poherdy (first interchangeable pertuzumab) and Armlupeg (pegfilgrastim) biosimilars

- EMA recommends approval for insulin glargine biosimilar Ondibta and denosumab biosimilar Osqay

- FDA approves denosumab biosimilars Osvyrti and Jubereq, Boncresa and Oziltus

- FDA approves aflibercept biosimilar Eydenzelt and label expansion for adalimumab biosimilar Yuflyma

- MORE EDITORIAL SECTIONS

- Search

0

0

Post your comment