How to market a new biosimilar is a key question, especially when taking into consideration the costs that are associated with developing a biosimilar. Whether the biosimilar will be a bulk (commodity) product or a differentiated product can have significant impact on the uptake of the biosimilar.

Positioning of biosimilars: commodity versus differentiated

Home/Reports

|

Posted 24/08/2012

2

Post your comment

2

Post your comment

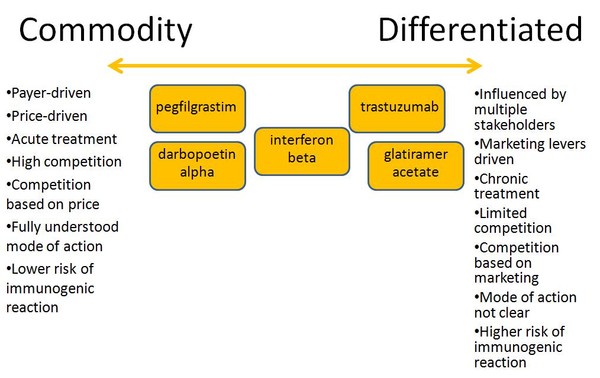

Uptake of biosimilars varies between different countries when therapy areas are considered according to drug class [1]. For example, the market for somatropin is differentiated due to a complex stakeholder landscape influenced by physicians, the competition is based on multiple marketing levers. This results in uptake of biosimilar somatropin being significantly lower than in commodity markets where access is mostly controlled by payers, e.g. tender, step-wise algorithms; and price competition, e.g. G-CSF, epoietins. Differentiated biosimilars are most likely when they are indicated for chronic treatment and/or long therapeutic cycles, where patients prefer to stick to a ‘known’ product. On the other hand, commodity biosimilars are most likely those indicated for acute treatment and/or frequent cycling among therapies.

Just looking at five of the biosimilars that have entered the regional markets or due to enter the global market in the coming years, you can find both commodity and differentiated products amongst them, see Figure 1.

Figure 1: Positioning of current and future biosimilars [1]

Uptake patterns will most likely vary across geographic clusters, and, for example, biosimilar insulins may perform better in emerging countries, such as Brazil, China,

India and Mexico. These countries have already developed their own regulatory pathways to manage the approval of biosimilars, with in general lower barriers in terms of clinical trial requirements and regulatory control than in Europe.

Editor’s comment

If you would like to receive figure 1* with added information on 12 forthcoming biosimilars, please send us an email.

*For profit organisations subjected to a fee

Related articles

European uptake of biosimilars

Biosimilars: key players and global market trends

Reference

1. Sheppard A. Iervolino A. Biosimilars: about to leap. 10th EGA International Symposium on Biosimilar Medicines; 2012 Apr 19; London, UK.

Permission granted to reproduce for personal and educational use only. All other reproduction, copy, retransmission or reprinting of all or part of any ‘Content’ found on this website is strictly prohibited without the prior consent of the publisher. Contact the publisher to obtain permission before redistributing.

Posted 20/09/2012 by Lasia, GaBI Online Editorial Office

Response to 'Commodity versus differentiated'

Dear Mr Swit,

Thank you for your comments. The interchangeability of biosimilars is under discussion. The 'Commodity' market has several criteria in order to make it work. We will publish a Biosimilars educational series (http://gabi-journal.net/gabi-journal/about-gabi-journal/future-activities/educational-book-series) and the topic of 'interchangeability' will be addressed.

Best regards,

Lasia, Publisher, GaBI Online

Posted 24/08/2012 by Michael A. Swit

Commodity versus differentiated

In the United States, under the emerging regime created by the Biosimilars Price Competition and Innovation Act, absent a finding of interchangeability, do you envision any non-interchangeable biosimilar ever being truly a commodity? Perhaps I am being semantical, but I do not see how a commodity market can emerge in that situation.

Guidelines

US guidance to remove biosimilar comparative efficacy studies

New guidance for biologicals in Pakistan and Hong Kong’s independent drug regulatory authority

Policies & Legislation

EU accepts results from FDA GMP inspections for sites outside the US

WHO to remove animal tests and establish 17 reference standards for biologicals

EU steps closer to the ‘tailored approach’ for biosimilars development

Home/Reports Posted 21/11/2025

Advancing biologicals regulation in Argentina: from registration to global harmonization

Home/Reports Posted 10/10/2025

The best selling biotechnology drugs of 2008: the next biosimilars targets

Post your comment