An estimated US$186 billion in sales revenues of patent-protected medicines is likely to be exposed to generic competition between now and 2016 [1].

Patent cliff and the generics industry

Home/Reports

|

Posted 01/07/2011

0

Post your comment

0

Post your comment

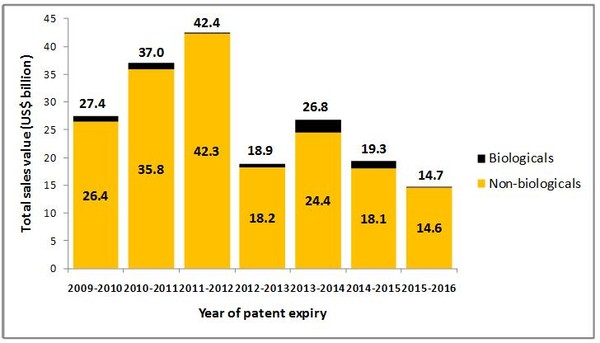

The majority of losses will occur in 2012 when many originator medicines will reach the so-called ‘patent cliff’ and where it is expected that more than US$42 billion in sales revenue will be lost by originator companies, see Figure 1.

Figure 1: Loss in global sales due to patent expiries

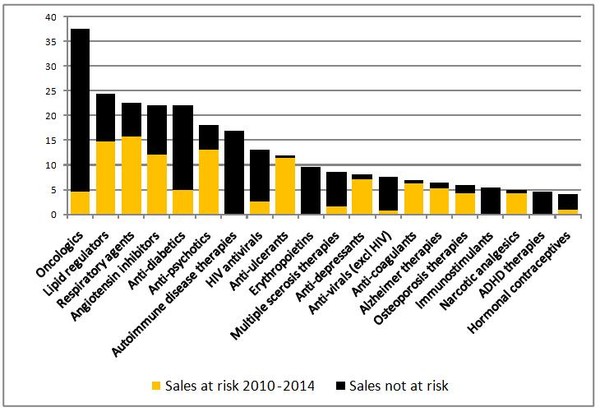

Almost all of the major pharmaceutical classes face significant generic competition in the next five years. Those set to be most affected–and at risk of losing 80% or more of their market share–include anti-ulcerants, anti-depressants, anti-coagulants, Alzheimer’s medications, osteoporosis medications and narcotic analgesics.

In terms of sales, lipid regulators (anti-cholesterol medication), respiratory agents, e.g. asthma treatments, angiotensin inhibitors, anti-psychotics and anti-ulcerants are all pharmaceutical classes at risk of losing sales worth more than US$10 billion or more for each class, see Figure 2.

The only pharmaceutical classes which will be immune to generic erosion are autoimmune disease therapies, erythropoietins and immunostimulants.

Figure 2: Pharmaceutical sales in 2009

This is good news for the generics industry, with many blockbuster medicines coming off patent there are huge opportunities for generics to gain market share, but it is not such good news for the originator companies.

On average, 44% of top 20 company sales are at risk of generic competition between 2009–2014. Nine of these top 20 companies, including Pfizer, AstraZeneca, sanofi-aventis, GSK, Merck, Eli-Lilly, Takeda and Bristol-Myers Squibb, will have 50% or more of their sales share exposed to patent expiry before 2014. Surprisingly Teva–a major generic manufacturer–is also among those at risk of losing 50% or more of its sales.

Related articles

Not only generics makers are well placed to move into biosimilars

Diversification of Big Pharma into generics and biosimilars

The growth in the generics industry

Big Pharma and the generics industry

Reference

1. Sheppard A. Generics; opportunities for some, threats for others: strategy shifts and new business models as a consequence. 5th Annual Generics Asia Summit 2010; 2010 Oct 25–26; Singapore.

Source: IMS Health

Guidelines

US guidance to remove biosimilar comparative efficacy studies

New guidance for biologicals in Pakistan and Hong Kong’s independent drug regulatory authority

Policies & Legislation

EU accepts results from FDA GMP inspections for sites outside the US

WHO to remove animal tests and establish 17 reference standards for biologicals

EU steps closer to the ‘tailored approach’ for biosimilars development

Home/Reports Posted 21/11/2025

Advancing biologicals regulation in Argentina: from registration to global harmonization

Home/Reports Posted 10/10/2025

The best selling biotechnology drugs of 2008: the next biosimilars targets

Post your comment