Biologicals are outstripping regular pharmaceuticals in terms of growth and taking a bigger and bigger chunk of overall drug sales. Increasingly, biosimilars and non-originator biologicals are also taking a small share of this market.

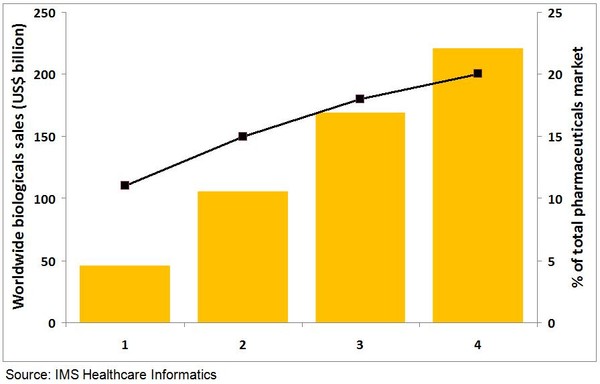

Total sales of biologicals have quadrupled from US$46 billion in 2002 to US$169 billion in 2012, see Figure 1. Over the same period biosimilars and non-originator biologicals have also increased their share of the biologicals market from 0.3% to 1.0%.

Figure 1: Worldwide biologicals sales in US$ and as a percentage of the total pharmaceutical market

Over the years, the relative contribution of therapeutic classes has changed. Erythropoietin products were the leading therapeutic class of biologicals in 2006 with sales of US$11.9 billion, but dropped to number six in the ranking by 2012 with sales of US$7.2 billion [1]. The growth of biologicals is being driven by monoclonal antibodies (mAbs) and human insulin, with four out of the top five biologicals in 2012 being mAbs.

One indicator of the strong growth of biologicals is the increase in the number of clinical trials in the past five years. Another indicator is the number of blockbusters, i.e. products with sales of more than US$1 billion per year. In 2006, there were 20 blockbuster biologicals, while in 2012 this has increased to 33. Biologicals are expected to continue to outpace overall pharmaceutical spending growth and are estimated to represent 19–20% of the total market value by 2017, reaching sales of US$221 billion.

Along with monoclonal antibodies, vaccines and therapeutic proteins are also expected to contribute significantly to the growth in the biologicals market, with an annual compound growth rate of more than 9.5% being predicted.

To date, biosimilars account for less than 0.5% of the value of the mature markets biologicals spend, whereas in pharmerging markets, non-original biologicals represent over 10% of all biologicals spending. In pharmerging markets, the rapid growth in the uptake of non-originator biologicals has been encouraged by market demand for cheaper alternatives to expensive originator biologicals and government policy aimed at increasing access to medicine. However, the increasing number of originator biologicals losing patent protection in regulated markets in the coming years also represents a significant opportunity for growth in the biosimilars market [2].

Related article

Biosimilars to replace 70% of chemical drugs

References

1. GaBI Online - Generics and Biosimilars Initiative. Biologicals sales have almost doubled since 2006 [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2014 Jan 31]. Available from: www.gabionline.net/Biosimilars/General/Biologicals-sales-have-almost-doubled-since-2006

2. GaBI Online - Generics and Biosimilars Initiative. US$67 billion worth of biosimilar patents expiring before 2020 [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2014 Jan 31]. Available from: www.gabionline.net/Biosimilars/General/US-67-billion-worth-of-biosimilar-patents-expiring-before-2020

Permission granted to reproduce for personal and non-commercial use only. All other reproduction, copy or reprinting of all or part of any ‘Content’ found on this website is strictly prohibited without the prior consent of the publisher. Contact the publisher to obtain permission before redistributing.

Copyright – Unless otherwise stated all contents of this website are © 2014 Pro Pharma Communications International. All Rights Reserved.

0

0

Post your comment