Biosimilars are an essential element of sustainable healthcare systems, with significant potential contribution to competitive markets. However, there are still challenges to be faced; for instance, there is a growing trend of biosimilar development targeting a limited range of biologicals [1].

The market concentration among biosimilars was discussed by Mr Aurelio Arias of IQVIA at the 19th Biosimilars Medicines Conference in May 2023.

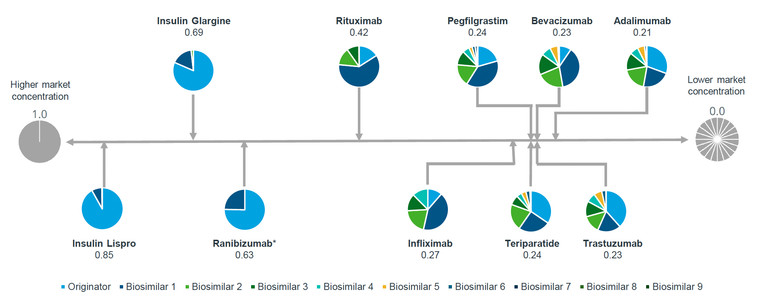

Mr Arias presented the Herfindahl-Hirschman Index (HHI) and shares held by competitor for various biologicals in 2022, including insulin lispro, insulin glargine, ranibizumab, rituximab, infliximab, pegfilgrastim, teriparatide, bevacizumab, trastuzumab and adalimumab. The HHI is a common measure of market concentration and is used to determine market competitiveness. The index measures the size of companies relative to the size of the industry they are in and the amount of competitiveness within that industry. In the context of this article, the HHI assesses both the number of competitors, including the originator, and the market share that each of them achieves. This approach provides a more nuanced view of market dynamics.

Figure 1: Disparity in biosimilars market concentration

Source: IQVIA; Herfindahl-Hirschman Index and shares by competitor (2022).

As illustrated in Figure 1 for molecules with biosimilar competition, their HHI scores range from 0.21 to 0.85. Adalimumab has the lowest market share concentration amongst the seven competitors, suggesting it is in a state close to perfect competition. Insulin Lispro, with an HHI score of 0.85 and only one biosimilar competitor, indicates a near monopoly.

In sustainable competitive markets, more competitors divide the market more evenly, leading to a low HHI score (indicative of near-perfect competition), whereas monopolies have a score of 1.0 (representing high market concentration and low competition).

The extent of market concentration disparity is evident from the number of biosimilars approved in Europe. By the end of August 2023, the European Medicines Agency has approved 10 biosimilars of adalimumab, eight biosimilars of bevacizumab, eight biosimilars of pegfilgrastim, six of trastuzumab, five biosimilars of rituximab, four biosimilars of teriparatide, four biosimilars of infliximab, three biosimilars of ranibizumab, two biosimilars of insulin glargine and one biosimilar of insulin lispro [2].

In summary, the biosimilar market is currently concentrated on a minority of biologicals, with some biosimilars having a much higher market share than others.

Related articles

Biosimilars uptake rates in Europe and the UK

US vs Germany and Switzerland: US biosimilars market lags with higher prices

|

LATIN AMERICAN FORUM

The new section of the ‘Latin American Forum’ on GaBI has been launched. The objective of this new section is to provide you with all the latest news and updates on developments of generic and biosimilar medicines in Latin America in Spanish. View the latest headline article: Biosimilares oftalmológicos en Canadá: la perspectiva de un prescriptor Browse the news in the Latin American Forum! Register to receive the GaBI Latin American Forum newsletter. Inform colleagues and friends of this new initiative.

FORO LATINOAMERICANO

Se ha lanzado la nueva sección del ‘Foro Latinoamericano’ sobre GaBI. El objetivo de esta nueva sección es brindarle las últimas noticias y actualizaciones sobre desarrollos de medicamentos genéricos y biosimilares en América Latina en español. Ver el último artículo de cabecera: Biosimilares oftalmológicos en Canadá: la perspectiva de un prescriptor !Explore las noticias en el Foro Latinoamericano! Regístrese para recibir el boletín informativo GaBI Foro Latinoamericano. Informe a colegas y amigos sobre esta nueva iniciativa.

|

References

1. GaBI Online - Generics and Biosimilars Initiative. Biosimilar development targets limited range of biologicals [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2023 Sep 22]. Available from: www.gabionline.net/reports/biosimilar-development-targets-limited-range-of-biologicals

2. Arias A. Filling the Biosimilar Void. 19th Biosimilars Medicines Conference; 2023 May 25-26: Amsterdam, The Netherlands. Medicines for Europe.

3. GaBI Online - Generics and Biosimilars Initiative. Biosimilars approved in Europe [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2023 Sep 22]. Available from: www.gabionline.net/Biosimilars/General/Biosimilars-approved-in-Europe

Permission granted to reproduce for personal and non-commercial use only. All other reproduction, copy or reprinting of all or part of any ‘Content’ found on this website is strictly prohibited without the prior consent of the publisher. Contact the publisher to obtain permission before redistributing.

Copyright – Unless otherwise stated all contents of this website are © 2023 Pro Pharma Communications International. All Rights Reserved.

0

0

Post your comment