2013 looks set to be another great year for generics and biosimilars, with once again some major blockbuster drugs losing patent protection.

2013’s biggest patent expiries

Home/Policies & Legislation

|

Posted 04/11/2011

0

Post your comment

0

Post your comment

Just looking at just five of the best-selling drugs, US sales of more than US$14 billion will be open to competition by the generics and biosimilars industry.

Key patent expiries in the US—according to data from market research firm IMS Health— include painkiller oxycontin (oxycodone), cancer treatment Zometa (zoledronic acid) and acid reflux treatment Aciphex (rabeprazole). These patent expiries can mean a major blow to some of the largest pharmaceutical companies, whilst it will be very good news for the generics and biosimilars industry and patients.

Table 1: Key patent expiries during 2013 in the US

| Brand name | Generic name | Treatment | Company | 2010 US sales ($) |

| Neupogen | filgrastim | Neutropenia | Amgen | 4,840,000,000* |

| Oxycontin | oxycodone | Painkiller | Purdue Pharma | 3,554,751,000 |

| Epogen | epoetin alfa | Anaemia | Amgen | 3,300,000,000 |

| Zometa | zoledronic acid | Cancer | Novartis | 2,100,000,000 |

| Aciphex | rabeprazole | GERD | Eisai Corporation | 915,796,000 |

*combined sales with Neulasta (pegfilgrastim)

GERD: gastroesophageal reflux disease; neutropenia: a lack of certain white blood cells caused by cancer

Sources: IMS Market Prognosis, April 2011, Reuters, Verispan, VONA

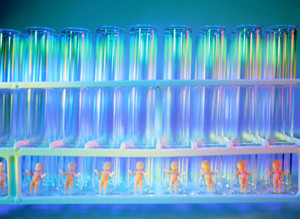

Two of Amgen’s blockbuster biologicals are included in the list of drugs set to lose patent protection in 2013. The company’s treatment for low white blood cells, Neupogen (filgrastim), and its cancer-induced anaemia treatment, Epogen (epoetin alfa), will both lose their patent protection in the US in 2013, by which time the FDA should hopefully have sorted out practical biosimilars guidelines. These two biologicals have already lost patent protection in Europe, where biosimilars for epoetin alfa were already introduced in 2007 and for filgrastim in 2008 [1].

Once drugs lose patent protection, lower-price generics rapidly gain market share, often siphoning off as much as 90% of sales. Benefits to patients are substantial, with generics averaging about 30% of the price of the brand-name originals.

Related articles

2012’s biggest patent expiries

2011’s biggest patent expiries

Reference

1. GaBI Online - Generics and Biosimilars Initiative. Biosimilars approved in Europe [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2011 October 28]. Available from: www.gabionline.net/Biosimilars/General/Biosimilars-approved-in-Europe

Source: CNBC, Quintiles

Guidelines

US guidance to remove biosimilar comparative efficacy studies

New guidance for biologicals in Pakistan and Hong Kong’s independent drug regulatory authority

WHO to remove animal tests and establish 17 reference standards for biologicals

Home/Policies & Legislation Posted 07/01/2026

ANVISA tackles 24-month backlog in biologicals post-registration petitions

Home/Policies & Legislation Posted 10/10/2025

The best selling biotechnology drugs of 2008: the next biosimilars targets

Post your comment