The lucrative biologicals market already boasts five of the world’s top 10 bestselling medicines [1], and by 2015, IMS Health expects spending on biosimilars to exceed US$2 billion annually, or about 1% of total global spending on biologicals [2]. Although major generics players are well placed to tap into this lucrative market, it is not an exclusive club, and R & D companies also have opportunities [3].

Europe has had guidelines in place for the approval of biosimilars since 2006 and has already approved 14 biosimilars, including biosimilar versions of human growth hormone, erythropoietin for anaemia treatment and granulocyte colony-stimulating factor against low white blood cell count levels [4]. The low number of approvals shows both the technical difficulties of producing such complex biological molecules and the high costs involved compared to small molecules.

The US on the other hand, although it now has a legal pathway—the Biologics Price Competition and Innovation Act of 2009, which was signed into force on 23 March 2010 by President Barack Obama, is yet to put practical guidance in place.

Until 12 May 2011, Sandoz, Novartis’s generics unit, is still the only manufacturer to have more than two biosimilars approved.

However, despite the difficulties there is much to gain and especially in the current climate of austerity measures, and with the threat of the patent cliff ever present, there are opportunities for Big Pharma as well as generics companies to diversify into biosimilars.

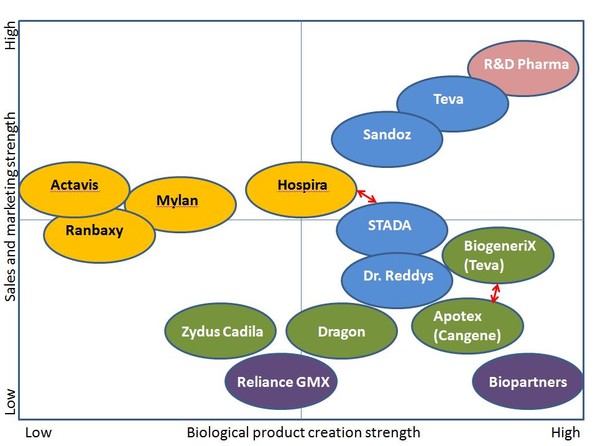

Companies that can combine biological expertise with the specific sales and marketing techniques required for biosimilars will be those most likely to succeed, see Figure 1.

Figure 1: Strengths and weaknesses for companies developing biosimilars

Source: IMS Health

Capabilities required for biosimilar development and commercialisation:

- marketing approach similar to original brands

- service approach

- investment in clinical trials.

Sales and marketing approaches for biosimilars:

- Sales and marketing requiring dedicated sales forces to inform prescribing physicians and hospitals.

- Investment above traditional generic levels will be needed pre-launch to gain approval.

- Investment post-launch will be needed to drive adoption of biosimilars.

- Adopt the marketing mindset of an originator to capitalise on the opportunity.

Related articles

Diversification of Big Pharma into generics and biosimilars

Impact of healthcare reforms

The growth in the generics industry

Patent cliff and the generics industry

Big Pharma and the generics industry

US guidelines for biosimilars

References

1. GaBI Online - Generics and Biosimilars Initiative. Samsung to enter biosimilars market [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2011 Aug 19]. Available from: www.gabionline.net/Biosimilars/News/Samsung-to-enter-biosimilars-market

2. GaBI Online - Generics and Biosimilars Initiative. Generics and biosimilars to drive down drug spending [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2011 Aug 12]. Available from: www.gabionline.net/Pharma-News/Generics-and-biosimilars-to-drive-down-drug-spending

3. Sheppard A. Generics; opportunities for some, threats for others: strategy shifts and new business models as a consequence. 5th Annual Generics Asia Summit 2010; 2010 Oct 25–26; Singapore.

4. GaBI Online - Generics and Biosimilars Initiative. Biosimilars approved in Europe [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2011 August 19]. Available from: www.gabionline.net/Biosimilars/General/Biosimilars-approved-in-Europe

0

0

Post your comment