Europe's oncology sector remains dominant, bolstered by numerous biosimilars. Despite current growth, a decline in biosimilar development from 2025 threatens future access, requiring strategic interventions to sustain progress.

Challenges and solutions in addressing the development void for oncology biosimilars

Home/Reports

|

Posted 13/08/2024

0

Post your comment

0

Post your comment

As the landscape of cancer treatment continues to develop, the role of biosimilars has become increasingly significant. However, the future availability of these alternatives is at risk due to several fundamental challenges.

Oncology is and will continue to be Europe's top therapeutic area [1]. The availability of numerous approved biosimilars for cancer treatment in both Europe (38 – 36% of approved biosimilars) and the US (22 – 39% of approved biosimilars) by the end of July 2024 indicates a growing acceptance and trust among doctors and pharmacists in their quality, safety, and efficacy, on par with their original counterparts [2]. However, there is a potential risk of limited access to biosimilars for cancer patients in the future due to a development void.

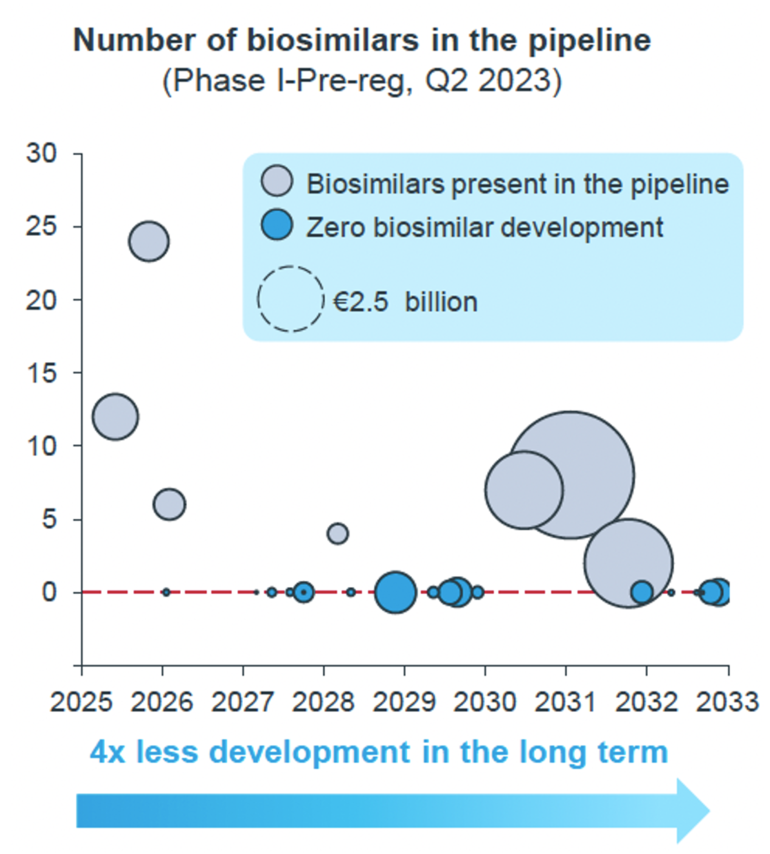

Figure 1 displays the number of oncology biosimilars in the development pipeline from 2025 to 2033, showing a significant decline in biosimilar development over time [3].

Figure 1: Development void of oncology biosimilars

Starting in 2025 there is a downward trend in the number of oncology biosimilars entering development. Initially, there are several biosimilars in the pipeline, but this number rapidly declines, representing fourfold decrease in development in the long term.

- In the short term (by 2027), oncology accounts for the largest share of biosimilar development programmes (44%)

- In the long term (2027 onward), the average number of biosimilars in development decreases from 2.19 per molecule to 0.43. This trend is driven largely by a significant decrease in the average number of onco-biosimilar candidates, which drops from 4.3 (short term, 2023-2027) to 1.2 (long term, 2028–2032)

By around 2029, there is a complete cessation of new biosimilar developments, resulting in a ‘development void period’ where no biosimilars are developed.

This stark reduction suggests significant barriers in the development pipeline for biosimilars over time, leading to fewer new biosimilar options for cancer patients in the future.

Overview of the main factors that could hinder biosimilar development and recommended strategies to counteract this decline:

- Challenges to biosimilars development: risk factors that contribute to reduced biosimilars development:

- Reference product costs: high costs of reference products make biosimilar development less attractive.

- Poor reimbursement and coverage: inadequate reimbursement policies and insurance coverage dissuade investment in biosimilars.

- Challenges in patient recruitment: difficulty in recruiting enough patients for clinical trials delays or halts biosimilar development.

- Manufacturing complexity: the intricate and costly manufacturing process of biosimilars presents significant hurdles.

- The highly dynamic nature of the field: rapid changes and advancements in oncology treatments make the biosimilar market highly unpredictable.

- Mitigation Strategies: possible solutions to counteract these risks factor:

- Streamlining clinical studies: simplify the clinical trial process to make it more efficient and less costly.

- Adaptive guidelines: implement flexible regulatory guidelines that can adapt to the rapid pace of innovation.

- Financial/Competitive incentives: offer financial incentives and foster competitive environments to encourage biosimilar development.

- Regulatory alignment: harmonizing regulations across different regions to facilitate smoother development and approval processes.

- Horizon scanning: identify emerging issues; assess implications; inform strategy; monitor change.

Failure to overcome biosimilar development barriers will strain European healthcare finances and limit patient access. This could reduce biosimilar availability, missing €15 billion in savings, affecting biological treatment cost efficiency and limiting the number of eligible patients receiving treatment.

Related articles

Highlights of EMA approvals in 2023 focus on cancer medicines

ASCO policy statement on biosimilars and interchangeables in oncology updated

|

LATIN AMERICAN FORUM View the latest headline article: Richmond lanzará los biológicos similares bevacizumab Yriviak y adalimumab Armada Browse the news in the Latin American Forum! Register to receive the GaBI Latin American Forum newsletter. Inform colleagues and friends of this new initiative.

FORO LATINOAMERICANO Ver el último artículo de cabecera: Richmond lanzará los biológicos similares bevacizumab Yriviak y adalimumab Armixa !Explore las noticias en el Foro Latinoamericano! Regístrese para recibir el boletín informativo GaBI Foro Latinoamericano. Informe a colegas y amigos sobre esta nueva iniciativa. |

References

1. GaBI Online - Generics and Biosimilars Initiative. Role of biologicals and biosimilars in cancer treatment amidst rising cases [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2024 Aug 13]. Available from: www.gabionline.net/reports/role-of-biologicals-and-biosimilars-in-cancer-treatment-amidst-rising-cases

2. GaBI Online - Generics and Biosimilars Initiative. Biosimilars in cancer treatment in Europe and the US. [www.gabionline.net]. Mol, Belgium: Pro Pharma Communications International; [cited 2024 Aug 13]. Available from: www.gabionline.net/reports/biosimilars-in-cancer-treatment-in-europe-and-the-us

3. 20th Biosimilars Medicines Conference, April 2024 Medicines for Europe. Future-proofing the Access Roadmap to The Next Wave of Cancer Medicines. Aurelio Arias.

Permission granted to reproduce for personal and non-commercial use only. All other reproduction, copy or reprinting of all or part of any ‘Content’ found on this website is strictly prohibited without the prior consent of the publisher. Contact the publisher to obtain permission before redistributing.

Copyright – Unless otherwise stated all contents of this website are © 2024 Pro Pharma Communications International. All Rights Reserved.

Guidelines

US guidance to remove biosimilar comparative efficacy studies

New guidance for biologicals in Pakistan and Hong Kong’s independent drug regulatory authority

Policies & Legislation

WHO to remove animal tests and establish 17 reference standards for biologicals

EU steps closer to the ‘tailored approach’ for biosimilars development

Home/Reports Posted 21/11/2025

Advancing biologicals regulation in Argentina: from registration to global harmonization

Home/Reports Posted 10/10/2025

The best selling biotechnology drugs of 2008: the next biosimilars targets

Post your comment