First posted: 22 November 2013

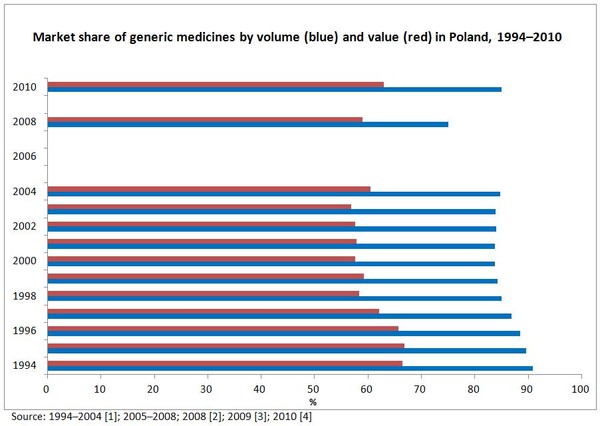

Poland has a mature generic medicines market. Irrespective of whether the shares are expressed by value or by volume, market shares of generic medicines fell in the 1990s, but stabilised in the early 2000s [1].

In 2010, market shares of generic medicines reached 63% by value and 85% by volume [4], see Figure 1.

Figure 1:Market share of generic medicines by volume and value in Poland, 1994–2010

Poland has pricing regulation of generic medicines included in the reimbursement system [5]. Setting the reference price at the price of the cheapest generic medicine in combination with the low level of medicine prices in Poland would be expected to keep down profitability of generic medicines. However, the economic viability of the Polish generic medicines market derives from the fact that it is a high-volume market as a result of the positive attitude of physicians towards generic medicines and the high level of patient co-payments [1].

Prescribing by international nonproprietary name (INN) is voluntary for physicians in Poland [6]. Physicians may prescribe as they wish, either by generic drug name, by brand name or by INN [2]. There are no other major incentives for physicians to prescribe generic drug products [1].

Both physician and patient may oppose generics substitution [6].

There are no rewards or sanctions for pharmacists for dispensing generics nor are there specific incentives or budgetary sanctions for physicians to prescribe generic medicines [2, 6].

Difficult economic conditions and limited government funds have increased patient co-payments, resulting in patients asking for the cheapest (generic) medicines for treating a given condition or illness [6]. Patient co-payments in Poland are some of the highest in the EU [7]. Patient co-payments for reimbursed medicines on average reach 33.4% [8].

There have been no initiatives to inform patients of generic medicines undertaken in Poland [1, 8].

Highlights of the generics market in Poland

- Market share of generic medicines by volume is 75%, accounting for 59% in value [2].

- The economic viability of the generics market originates from low prices and high volume of consumption [1].

- Setting the reference price at the level of the cheapest medicine has led to low prices of generics [1].

- The high volume of consumption derives from the positive experience of physicians with generics and the high level of patient co-payments [1].

References

1. Simoens S, De Coster S. Sustaining Generic Medicines Markets in Europe. April 2006. [monograph on the Internet]. Brussels, Belgium, European Generic Medicines Association (EGA); [cited 2013 Nov 22]. Available from: www.egagenerics.com/doc/simoens-report_2006-04.pdf

2. Österreichisches Bundesinstitut für Gesundheitswesen (ÖBIG). Access to Essential Medicines in Poland. August 2009.

3. Sheppard A. Generic Medicines: Essential contributors to the long-term health of society: Sector sustainability challenges in Europe. IMS Health.

4. Neil Goodman. Personal communication. 11 March 2011.

5. Bongers F, Carradinha H. European Generic medicines Association Health Economics Committee. How to Increase Patient Access to Generic Medicines in European Healthcare Systems. June 2009.

6. Österreichisches Bundesinstitut für Gesundheitswesen (ÖBIG). Surveying, Assessing and Analysing the Pharmaceutical Sector in the 25 EU Member States. July 2006.

7. European Federation of Pharmaceutical Industries and Associations. The pharmaceutical industry in figures [homepage on the Internet]. 2010.

8. Pharmaceutical Pricing and Reimbursement Information Poland. October 2007.